vermont sales tax exemptions

Free Unlimited Searches Try Now. 53 rows Exemption extends to sales tax levied on purchases of restaurant meals.

The Vermont Statutes Online Title 32.

. Beer over 6 percent alcohol by volume. Agricultural field burning reduction Expired January 1 2011. All Major Categories Covered.

Vermont CVR 10-060-023 Reg. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Sales up to 500000.

Meals and Rooms Tax see p. Taxation and Finance Chapter 233. Ad New State Sales Tax Registration.

974113 with the exception of soft drinks. Additionally wholesalers must pay a tax on spirits and fortified wines as follows. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

Select Popular Legal Forms Packages of Any Category. Ad Lookup State Sales Tax Rates By Zip. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

Clothing and footwear priced 175 or less per itempair are generally exempt from Massachusetts sales tax use tax. This vehicle is also. Groceries clothing prescription drugs and non-prescription drugs are exempt from the.

Sales tax applies to any individual. 9741 9741. Retail sales tax and use tax exemptions are available to qualified farmers for the purchase or use of certain equipment.

Download tax rate tables by state or find rates for individual addresses. SALES AND USE TAX Subchapter 002. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

The registrant or lessee must be licensed in Vermont as a VT Rental Company and will be required to submit a completed Rental Tax Exemption form VD-030. How to use sales tax exemption certificates in Vermont. This page discusses various sales tax exemptions in Vermont.

Tax Bulletin 7-11. While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. 19242-3 Meals and Rooms Tax TB-13.

Sales tax exemption can only be. Vermont Sales Tax Exemption Certificate information registration support.

States Without Sales Tax Article

States Without Sales Tax Article

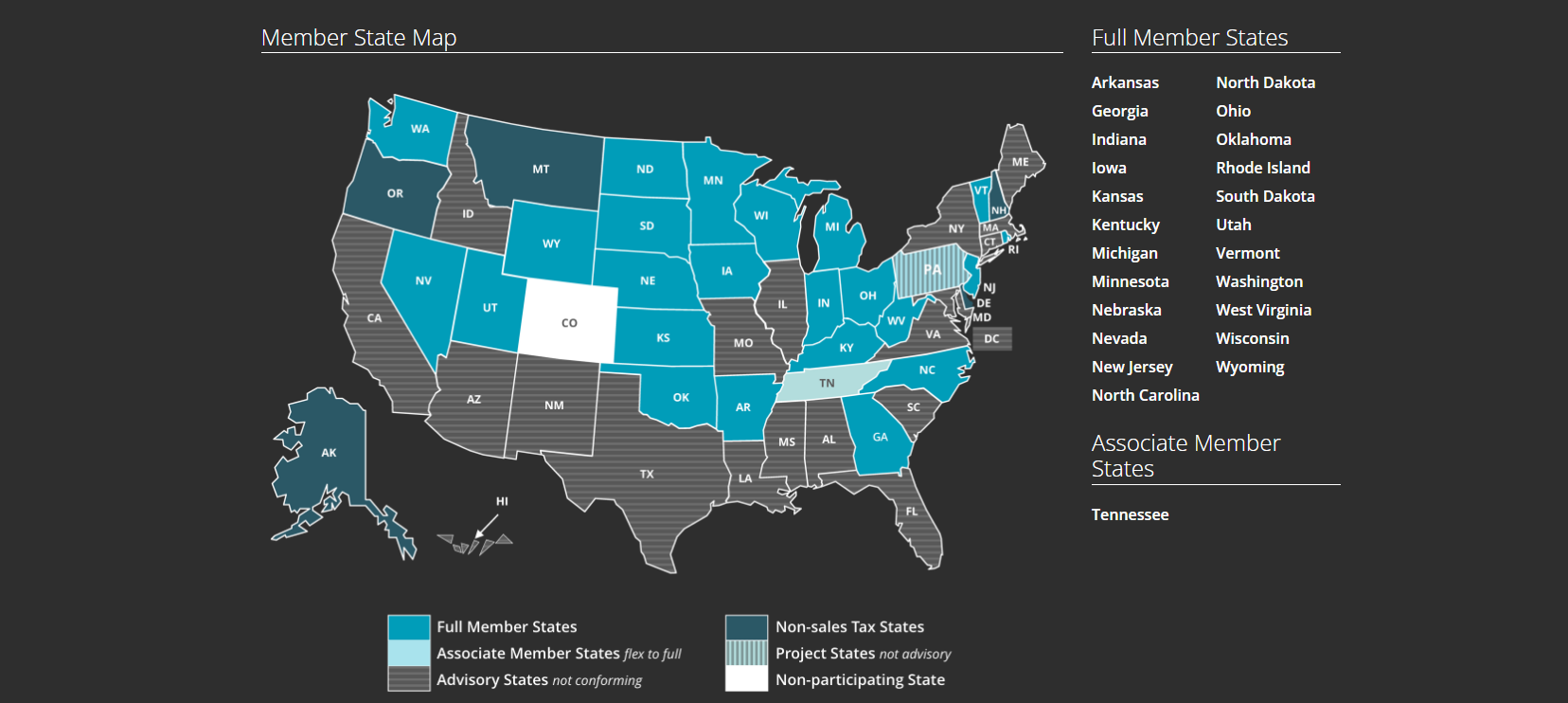

Streamlined Sales Tax Free Solution For Online Sellers

What Is Avatax Ins And Outs Of Avalara Sales Tax Software

Push Is On To Expand Vt Sales Tax To Services Ethan Allen Institute

Pennsylvania Sales Tax Small Business Guide Truic

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Sales Taxes In The United States Wikiwand

States Without Sales Tax Article

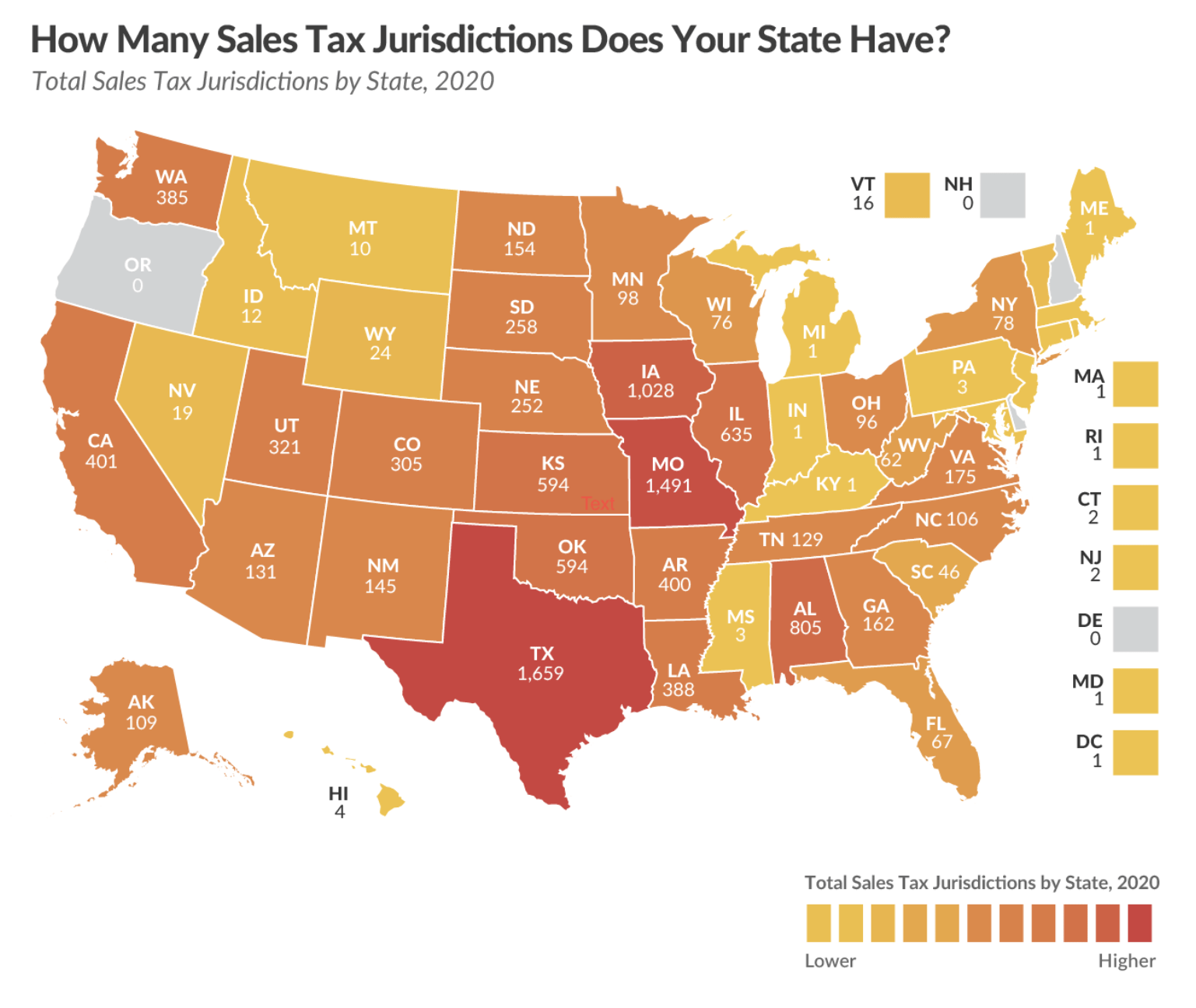

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

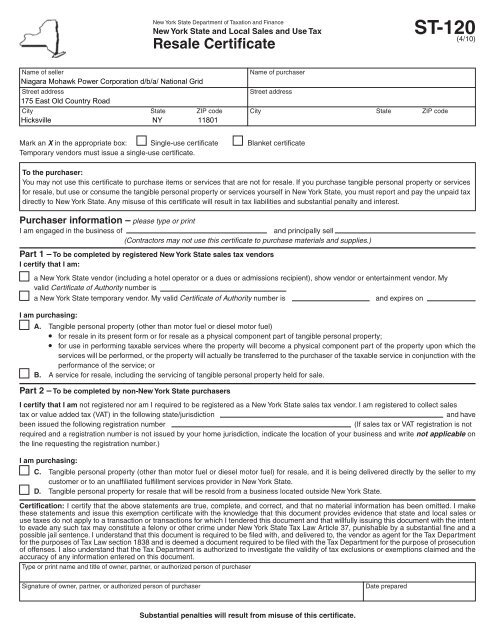

New York Sales Tax Exemption Form National Grid

Drop Shipping And Sales Tax A Simple Guide Bench Accounting

State Corporate Income Tax Rates And Brackets Tax Foundation

Sales Tax Holidays Politically Expedient But Poor Tax Policy

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management